The Only Guide for Paul B Insurance Local Medicare Agent Huntington

Wiki Article

The Paul B Insurance Medicare Advantage Plans Huntington PDFs

Table of ContentsExcitement About Paul B Insurance Insurance Agent For Medicare HuntingtonPaul B Insurance Insurance Agent For Medicare Huntington for DummiesThe Ultimate Guide To Paul B Insurance Local Medicare Agent HuntingtonSee This Report about Paul B Insurance Medicare Advantage Plans HuntingtonPaul B Insurance Medicare Agent Huntington - An Overview

(People with certain impairments or health conditions may be eligible before they turn 65.) It's developed to protect the wellness as well as wellness of those who utilize it. The 4 parts of Medicare With Medicare, it is essential to understand Parts A, B, C, and also D each part covers particular services, from treatment to prescription drugs.

If you're already obtaining Social Safety benefits, you'll immediately be enrolled in Component An as quickly as you're eligible. Find out about when to enlist in Medicare. You can obtain Component A at no charge if you or your partner paid right into Medicare for a minimum of ten years (or 40 quarters).

The Ultimate Guide To Paul B Insurance Medicare Advantage Agent Huntington

Medicare Advantage is an all-in-one strategy that bundles Original Medicare (Component An and also Component B) with fringe benefits. Kaiser Permanente Medicare wellness plans are examples of Medicare Advantage plans. Remember that you require to be enrolled partly B and eligible for Part A before you can authorize up for a Medicare Benefit plan.

Prior to we talk regarding what to ask, let's speak about that to ask. For numerous, their Medicare journey starts directly with , the main internet site run by The Centers for Medicare and Medicaid Solutions.

The Paul B Insurance Medicare Part D Huntington Statements

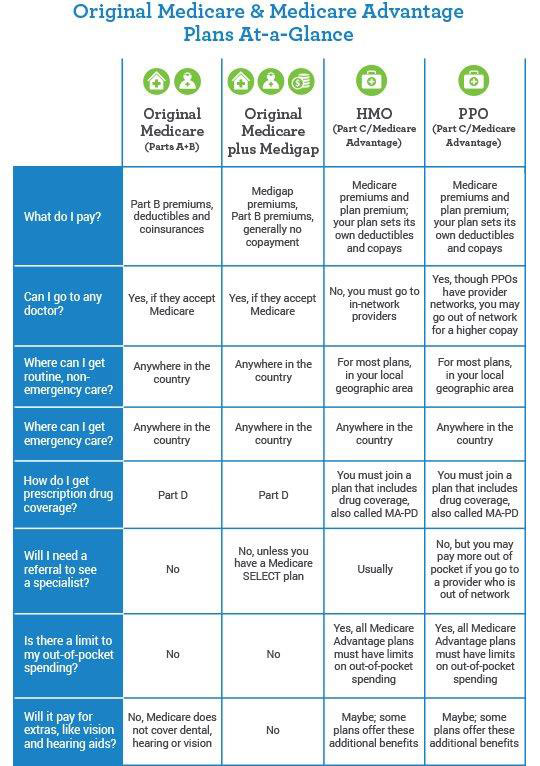

It covers Part A (healthcare facility insurance) and also Component B (clinical insurance). This includes points that are taken into consideration medically required, such as medical facility remains, routine physician check outs, outpatient solutions as well as more. is Medicare insurance coverage that can be bought directly from a personal healthcare firm. These strategies function as a different to Initial Medicare, integrating the protection options of Components An as well as B, as well as fringe benefits such as oral, vision and also prescription drug insurance coverage (Component D).Medicare Supplement plans are a fantastic enhancement for those with Initial Medicare, aiding you cover expenses like deductibles, coinsurance as well as copays. After obtaining care, paul b insurance Medicare Advantage Agent huntington a Medicare Supplement strategy will pay its share of what Original Medicare didn't cover then you'll be in charge of whatever stays. Medicare Supplement plans normally do not consist of prescription medicine protection.

You can enroll in a separate Component D plan to include medication protection to Original Medicare, a Medicare Price plan or a few other kinds of strategies. For many, this is often the first concern considered when browsing for a Medicare strategy. The cost of Medicare varies relying on your healthcare requirements, financial support qualification as well as exactly how you select to get your benefits.

The Facts About Paul B Insurance Insurance Agent For Medicare Huntington Revealed

For others like seeing the physician for a lingering sinus infection or filling a prescription for protected prescription antibiotics you'll pay a fee. The quantity you pay will be different depending upon the kind of strategy you have as well as whether you've cared for your deductible. Medication is an essential part of take care of lots of people, specifically those over the age of 65.and seeing a carrier who accepts Medicare. However what concerning traveling abroad? Lots of Medicare Benefit plans supply international insurance coverage, along with protection while you're traveling domestically. If you intend on traveling, make certain to ask your Medicare expert regarding what is and isn't covered. Possibly you have actually been with your present physician for some time, and you intend to maintain seeing them.

Many individuals that make the button to Medicare continue seeing their regular medical professional, but also for some, it's not that straightforward. If you're collaborating with a Medicare consultant, you can ask them if your doctor will certainly remain in network with your brand-new strategy. If you're looking at plans independently, you may have to click some web links and make some telephone calls.

The Definitive Guide to Paul B Insurance Medicare Part D Huntington

gov site to seek out your existing medical professional or another supplier, facility or healthcare facility you desire to use. For Medicare Advantage strategies and Cost plans, you can call the insurance policy business to make sure the doctors you intend to see are covered by the plan you have an interest in. You can likewise inspect the strategy's site to see if they have an on the internet search device to locate a protected medical professional or facility.Which Medicare plan should you go with? Begin with a checklist of considerations, make certain you're asking the right inquiries and start concentrating on what kind of strategy will best serve you as well as your requirements.

Medicare Benefit strategies are personal insurance coverage policies that assist with the spaces in Medicare protection. Although they appear comparable to Medigap plans, don't perplex the 2, as they have some notable distinctions. To be eligible for Medicare Benefit enrollment, you should first register for Original Medicare (Medicare Component An as well as Component B).

Report this wiki page